I have recently wrote an opinion piece in BRIC Magazine relating to why I think oil prices will rise from current lows. Here is some backing information I have used in formulating that argument.

The collapse of oil prices that started in July of 2014 has had wide-ranging implications on the fortunes of most oil producing nations and has received endless coverage in the media with particular attention being paid to the negative effects on their economies. As such, a number of opinions have become prevalent in the market – in particular the resulting weakness of the Russian economy and the likely resilience of Saudi Arabia.

It is therefore of interest to see what the real big picture of the situation is and its likely effect on the health of this group of countries going forward.

First, let’s start by looking at the difference in the cost of oil production (i.e. the physical cost to extract a barrel from the ground) and the market price that is needed by a country to balance their budget (i.e. what price the country then needs to sell the oil on the open market in order to generate sufficient revenue to cover government expenses on infrastructure, welfare etc.).

Figure 1: Breakeven production and budget breakeven costs. Source: Agora Financial and Total S.A.

As we can see from Figure 1, there is a wide gap between cost of producing a barrel of oil and the required sale price needed to budget the balance.

For instance, Saudi Arabia can produce oil at very competitive prices – c.$5-$10 per barrel, however needs to sell it at a minimum of $75 to balance its budget. This is similar to the price Russia needs to balance its budget, however Russia’s cost of production are almost double those of Saudi Arabia.

Why is this difference so high? In order to understand this, we need to look at how much of a countries’ GDP is based on their Export earnings.

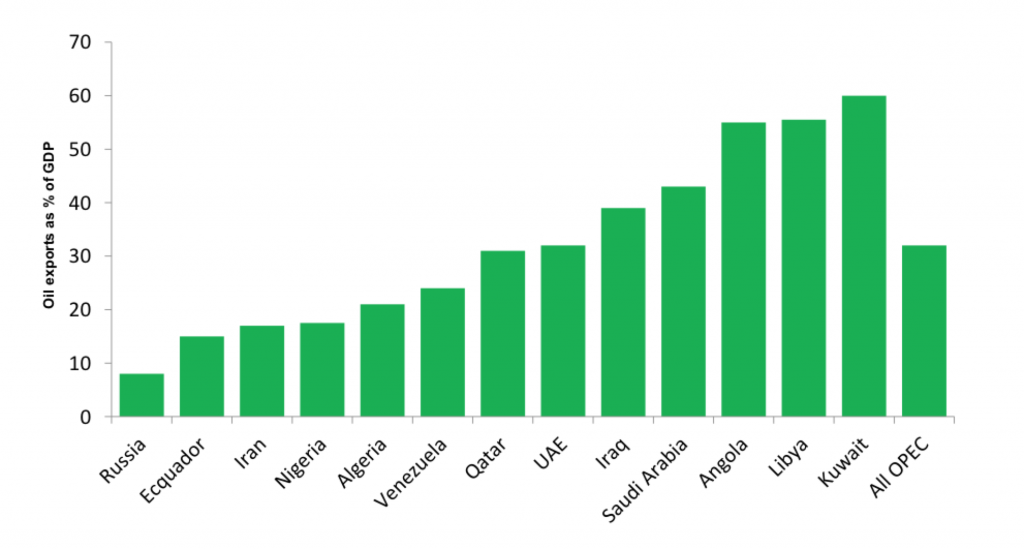

Figure 2: Oil export earnings as % of GDP. Source: euanmearns.com

Looking at Figure 2, the picture becomes rather interesting. We see that certain oil producing countries, such as Kuwait, Saudi Arabia and Iraq are far more reliant on oil revenue for their GDP income than more diversified economies such as Russia and even Iran. As such the next question that is worth asking is – what will be the effect on a governments’ annual deficit if oil stays at $50?

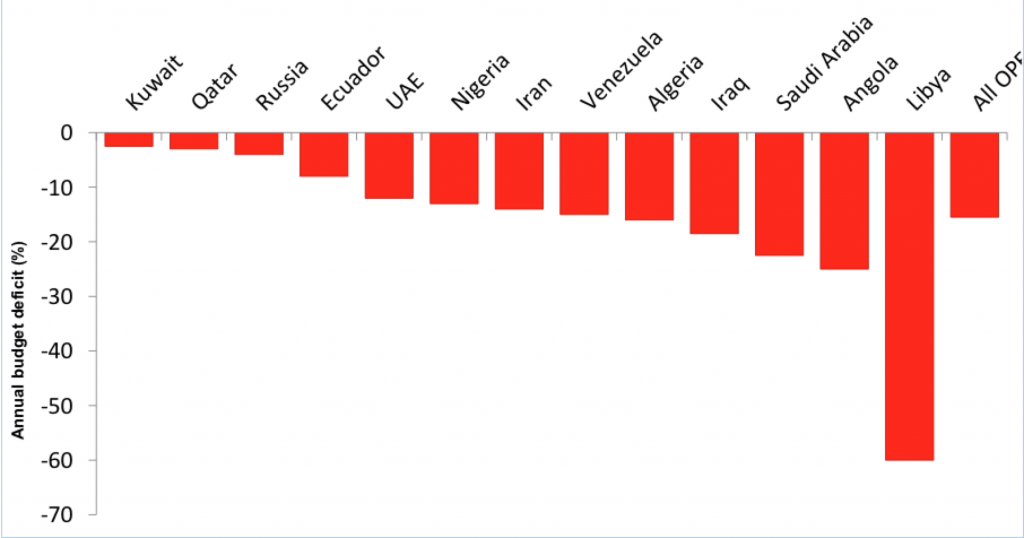

Figure 3: Annual government deficit at US$50 / barrel. Source: euanmearns.com

Figure 3 shows the impact on state economies of a sustained fall in oil price to US$ 50 per barrel. Whereas Kuwait, Qatar and Russia will be least hit by this situations most oil producers, including UAE, Venezuela and Saudi Arabia will be strongly affected.

Since countries will be using their foreign reserves to plug in gaps in their domestic reserves, the final question we need to ask is – how long will these last?

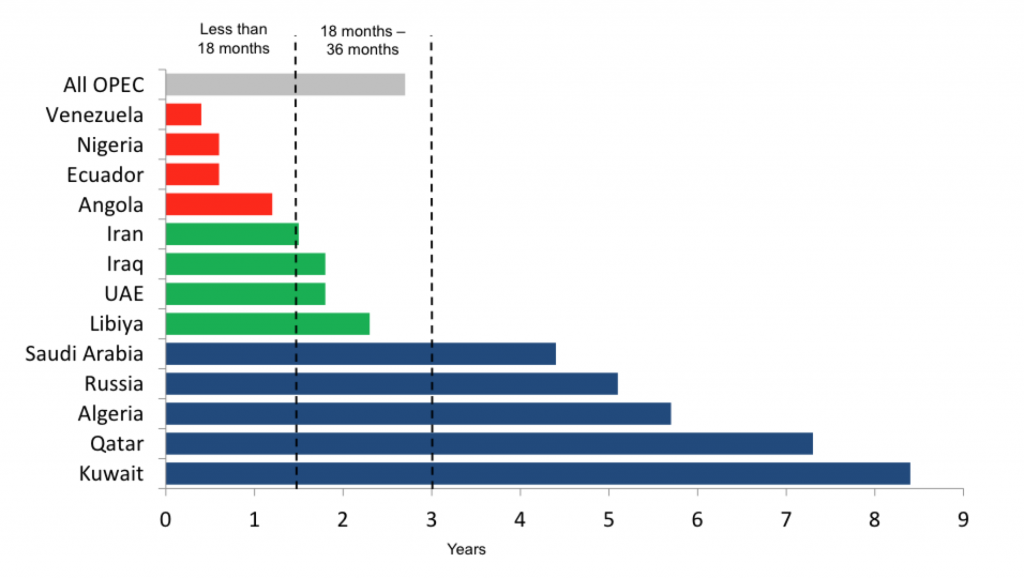

Figure 4: Duration of foreign reserves at US$ 50 per barrel. Source: euanmearns.com

Looking at Figure 4, we can see that if oil remains at US$50 per barrel, Venezuela, Nigeria, Ecuador and Angola will ruin out of foreign reserves within 18 months and will require international assistance. Iran, Iraq, UAE and Libya will be able to last for another 24 months and only Saudi Arabia, Russia, Algeria, Qatar and Kuwait will be able to sustain a prolonged oil price glut of 4 years or more.

- Sources

- http://oilprice.com/Energy/Oil-Prices/Oil-Wars-Why-OPEC-Will-Win.html

http://uk.businessinsider.com/citi-breakeven-oil-production-prices-2014-11

http://wolfstreet.com/2014/09/12/the-countries-most-at-risk-from-declining-oil-prices/

http://graphics.wsj.com/lists/opec-meeting

If you like this article you may be interested in “Ask the Experts: Is This The Next Global Crisis?”.