Iran is changing. After decades apart from the world economy, recent developments show that this era is coming to an end. Iran’s engagement in talks with the United States and the West could soon come to a successful conclusion. The negotiations are not one-sided. For agreeing to scale back on its nuclear programme, Iran will be welcomed into world trade once again. The lifting of sanctions will resume the decades-delayed trade between Iran and the West, providing consumer goods, and a valuable trade flow. It seems like a winning situation for all involved. But some countries may not be so thrilled. If Iran is welcomed back with open arms into the world’s economy, its current trade partners risk significant competition.

After the revolution in 1979, relations between Iran and many Western nations quickly soured. In 2002, with the launch of the nuclear programme, economic sanctions came thick and fast. The United Nations, the United States, and the European Union all introduced measures to freeze the assets of individuals and companies, significantly reduce imports and exports, and ban Iranian bank transfers.

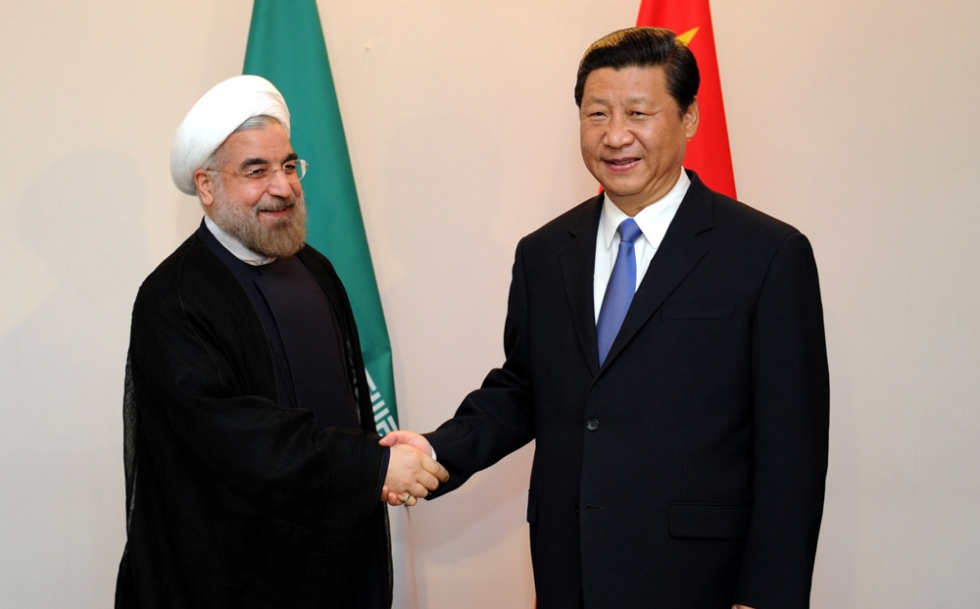

Iran’s main trading partners are China, the United Arab Emirates, and Turkey.

Although Iran remains on good economic terms with the world’s largest economy, a thaw in relations with the West would be welcomed. Well, not by some countries.

India

India enjoys a privileged trading relationship with Iran. When other countries imposed sanctions, India, like a few others, did not back them. For this, its businesses have been generously rewarded. In three years, Indian exports to Iran doubled to $5bn. The good times, however, may be over. There are genuine worries about the state of India’s economy should Iran and the West reach a satisfactory deal. Indian exports have already fallen by 20%, and competition in the Iranian market would only cause more problems. India’s exports with the country are mostly industrial in nature, but agricultural markets would also be effective. Taking advantage of the sanctions, India charged Iran a 20% premium on rice and other crops. Perhaps this won’t be possible much longer.

Saudi Arabia

It has been well over a decade since EU countries officially stopped importing Iranian oil. The economic impact on Iran has been nothing short of devastating. Between 2011 and 2013, because of the loss of export demand, oil production fell to 700,000 barrels per day. The export gap reportedly costs Iran billions of dollars each week. Without this extra competitor, Saudi Arabia has been the clear leader. Saudi Arabia exports over seven times the amount of oil that Iran exports, and provides, together with Norway and Russia, 53.7% of the EU’s oil imports. If Iranian oil is once again accepted into Europe, Saudi Arabia could see its share dwindle.

China

China was the largest economy not to impose economic sanctions on Iran. As a result, it has enjoyed a healthy trade relationship with the country. 21% of Iran’s exports and 17% of imports are due to China. This trade is predicted to reach $60bn annually. European companies are set to return to Iran to provide consumer products, a major Chinese export. China also provides machinery and engineering expertise to Iran. An EU relaxation in trade sanctions would bring Germany, where engineering is the backbone of its economy, into competition with China.

Iran’s transition from an economic pariah state to a key member of the global economy will not happen overnight.

There is no guarantee that a nuclear deal will be reached. Regardless, Iran’s current trade partners, and those of the West are nervous. Iran’s population seeks goods, and the West seeks resources. But if and when Iran is welcomed, one thing is certain. The economic balance of the world will be changed dramatically.